In conclusion, bookkeeping and accounting are crucial for the success of any auto repair store. By keeping correct information, using accounting software program, and analyzing monetary information, you can even make knowledgeable choices and make sure that your business is succeeding. Coaching your team and implementing repeatable processes for logging and monitoring each part will save you time down the road.

Auto store management software program is a computer program that helps handle the day-to-day operations of an auto repair store. It’s a powerful tool that can assist streamline processes and improve effectivity, ultimately resulting in elevated earnings. Have you ever wondered how auto restore outlets manage high-value stock, complicated financing options, and fluctuating service department costs? Accounting software program for general companies works nice in plenty of industries, however auto restore retailers have unique wants. To streamline your operations, you’ll need a software resolution that’s tailor-made to the automotive trade. To monitor bills, use accounting software to routinely record and classify overhead prices in addition to these for instruments, materials, and labor.

By investing in the best software program, auto shops can save money and time and improve their bottom line. Interestingly, the advantages of these software program options aren’t unique to auto restore retailers; they can be prolonged to automobile dealerships as nicely. Like auto restore retailers, automobile dealerships deal with a wide selection of financial transactions day by day, together with vehicle gross sales, parts stock administration, customer financing, and more.

- Whatever the cause, a slowdown doesn’t have to imply misplaced momentum (or money).

- The Wave Accounting software program contains a modern interface and diagramming instruments to help recognize fraudulent actions.

- Regular audits, both internal or exterior, can additional enhance the accuracy and reliability of these reviews.

- Extra particularly, accurate bookkeeping is important for measuring profitability, allowing store homeowners the chance to determine areas for revenue and cost discount.

With a safer, easy-to-use platform and a median Pro experience of 12 years, there’s no beating Taxfyle. Environment Friendly credit and collection insurance policies are important for maintaining healthy cash circulate. One of the complexities in revenue recognition arises from the various parts that can be included in a automotive sale. These components might embrace the sale of the automobile 6 ways auto repair shops can ease bookkeeping, accounting, and payments itself, prolonged warranties, service contracts, and financing arrangements.

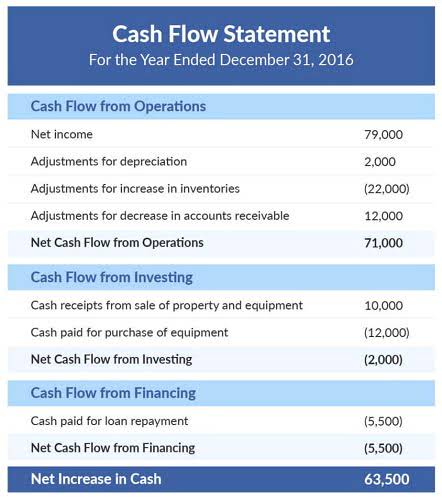

Alongside operating on a price range, it’s additionally important for bookkeeping for auto outlets to watch your cash circulate and the cash coming out and in of your small business. This will assist you to ensure you have enough money https://tax-tips.org/ in your accounts to cowl bills and pay your workers. Your accounting software program might help you track your money flow and flag any points that should be addressed. Managing customer payments and offering financing choices are important components of customer service and income management in an auto repair store. Offering a selection of payment strategies, including bank cards, digital wallets, and contactless payments, can enhance the client expertise and facilitate faster transactions. Implementing a secure and user-friendly fee processing system, such as Sq or Stripe, can streamline this course of and reduce the danger of cost errors or fraud.

]]>

In Oregon, the average property tax rate as a percentage of assessed home value is 0.77% according contribution margin to the Tax Foundation. Oregon’s income tax brackets are high compared to most other states, and the state taxes most types of retirement income. Taxpayers have several official methods for submitting their completed Oregon income tax return.

Oregon Paycheck Calculator

- While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

- The most common method is electronic filing (e-filing) through approved commercial tax preparation software or through the free file options available on the Oregon DOR website.

- The state also provides its own standard deduction or allows for itemized deductions, which may differ from the federal amounts.

- Most properties are taxed by a number of districts, such as a city, county, school district, community college, fire district or port.

Taxpayers who are blind or over 65 get an additional standard deduction of $1,200 for single filers and $1,000 per qualifying person for those filing a joint return. Forty-four states levy a corporate income tax, with top rates ranging from a 2.25 percent flat rate in North Carolina to a 11.5 percent top marginal rate in New Jersey. Employers and payroll departments should ensure that withholding reflects the correct rates and brackets for 2025. New residents should update their withholding forms to avoid surprises at tax time. While there is no statewide sales tax, some local jurisdictions impose specific, narrowly defined taxes that can resemble sales taxes.

- The Paid Leave contribution rate will continue to be 1% of subject wages up to $184,500 per employee for 2026.

- In Oregon, the average property tax rate as a percentage of assessed home value is 0.77% according to the Tax Foundation.

- Because of the inherently local nature of property tax collections in Oregon, rates vary significantly between counties.

- At Unbiased, we match you with a financial advisor perfectly suited to meet your needs.

- As mentioned, property tax is an important source of revenue for the state.

- Part-year residents must calculate tax liability on income earned while a resident, plus any Oregon-sourced income earned while a non-resident.

Tax Season Oregon Tax Tables

- Property tax averages from this county will then be used to determine your estimated property tax.

- The Levy Code Area number can be found at the top middle of your tax bill between the legal description and account number.

- In addition to the Corporate Tax and Excise Tax, the State of Oregon also has a Gross Margins Tax referred to as the Corporate Activity Tax (similar to Ohio’s CAT Tax).

- If you are a Oregon business owner, you can learn more about how to collect and file your Oregon sales tax return at the 2025 Oregon Sales Tax Handbook .

- Cigarette tax avoidance costs states billions in forgone tax revenue and necessitates additional spending on enforcement of the ineffective policies.

Its property taxes are also below average when compared to other states. For details about mortgages in the state, including rates and specifics about each county, check out our comprehensive Oregon mortgage guide. Beyond federal income taxes, your employer will also withhold Social Security and Travel Agency Accounting Medicare taxes from each of your paychecks. Social Security tax is withheld at 6.2% and Medicare tax at 1.45% of your wages. Your employer then matches those amounts, so the total contribution is double what you paid.

State Business Taxes in Oregon

The state uses a four-bracket progressive state income tax, which means that higher income levels correspond to higher state income tax rates. For 2024, single filers and married couples filing separately with more than $125,000 in taxable income have to pay that top rate. That income threshold is doubled for married people filing together and heads of household. Oregon has a graduated state individual income tax, with rates ranging from 4.75 percent to 9.9 percent. tax rate in oregon There are also jurisdictions that collect local income taxes, with high taxes in the Portland Metro area. Oregon has a graduated corporate income tax, with rates ranging from 6.6 percent to 7.6 percent.

At VisaVerge, we understand that the journey of immigration and travel is more than just a process; it’s a deeply personal experience that shapes futures and fulfills dreams. Our mission is to demystify the intricacies of immigration laws, visa procedures, and travel information, making them accessible and understandable for everyone. Katelyn has more than 6 years of experience working in tax and finance. She believes knowledge is the key to success and enjoys providing content that educates and informs. When it comes to shopping, Oregon is one of only five states in the country with no sales tax, which means you won’t see extra charges tacked on at the register.

]]>

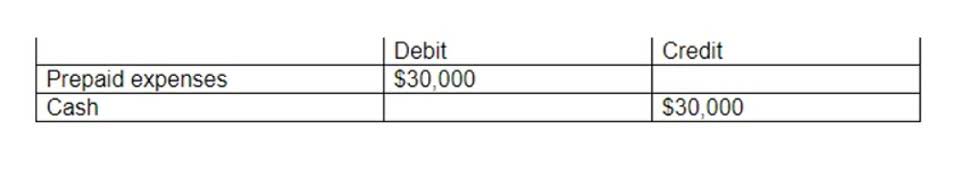

The totals indicate that as of midnight on December 7, the company had assets of $17,200 and the sources were $7,120 from the creditors and $10,080 from the owner of the company. The accounting equation totals also tell us that the company had assets of $17,200 with the creditors having a claim of $7,120. Although owner’s equity decreases with a company expense, the transaction is not recorded directly into the owner’s capital account at this time. Instead, the amount is initially recorded in the expense account Advertising Expense and in the asset account Cash.

- On the other hand, overly cautious estimates could hurt a company’s profitability and future decisions.

- Things that are resources owned by a company and which have future economic value that can be measured and can be expressed in dollars.

- They represent things you owe others, and a common liability is a loan liability, which is reflected on the balance sheet.

- The accounting equation ensures that a company’s financial records remain balanced and accurate, forming the foundation of double-entry accounting.

- The proceeds of the bank loan are not considered to be revenue since ASC did not earn the money by providing services, investing, etc.

The Accounting Equation: Definition and Formula

These Bookkeeping vs. Accounting details don’t change the numeric value of the different components but act as notations telling stakeholders or potential investors more about the source of each financial entry. As a result of this transaction, the asset (cash) and the liability (accounts payable) both decreased by $8,000. As a result of this transaction, the liability (accounts payable) and asset (furniture) both increased by $16,000. Typically, an increase in revenues will result in an increase in the value of an owner’s equity. They might be known by a number of different names and come from a variety of different places, depending on the kind of business they are in.

How the Equation Keeps Balance

It expands upon the basic accounting equation to include revenues and expenses, providing a dynamic view of a business’s financial performance over time. This article explores the concept of what are retained earnings the business equation, its components, practical examples, and its significance in financial reporting and decision-making. In double-entry accounting or bookkeeping, total debits on the left side must equal total credits on the right side.

Construction Company Expansion (Table)

Below are some examples of transactions and how they affect the accounting equation. You can use the same equation to forecast future financial positions, simply by plugging in projected numbers for income, expenses, loans, and investments. Under the accrual basis of accounting, this account reports the cost of the temporary help services that a company used during the period indicated on its income statement. A long-term asset account reported on the balance sheet under the heading of property, plant, and equipment.

- Similarly, while goodwill from acquisitions is recorded, intangible contributions like employee creativity and customer relationships may be skipped despite their substantial value.

- Also known as the basic accounting equation or balance sheet equation, the accounting equation is used by any business currently using double-entry accounting as a way to keep their books balanced.

- For nonprofits, equity is often referred to as net assets, but the concept is similar — it represents what the organization truly owns after covering all its obligations.

- Total debits and credits must be equal before posting transactions to the general ledger for the accounting cycle.

- Only after debts are settled are shareholders entitled to any of the company’s assets to attempt to recover their investment.

The business equation expands the traditional accounting equation to provide a dynamic view of a company’s financial activities. By incorporating revenues and expenses, it connects financial performance with financial position, offering a comprehensive framework for analysis and decision-making. In above example, we have observed the impact of twelve different transactions on accounting equation. Valid financial transactions always result in a balanced accounting equation which is the fundamental characteristic of double entry accounting (i.e., every debit has a corresponding credit).

- The concept of expanded accounting equation is that it shows further detail on where the owner’s equity comes from.

- When it increases, there must be a corresponding increase in either liabilities or equity to maintain the balance.

- Every transaction affects at least two accounts to maintain balance—hence the “double” in double-entry.

- This disconnect can also result in investors or stakeholders having an inaccurate understanding of the company’s true market value.

- This transaction impacted his inventory account, which is an asset, and increased his accounts payable account, which is a liability.

- These examples highlight the flexibility of the business equation in capturing every possible transaction scenario.

This is an owner’s equity account and as such you would expect a credit balance. Other examples include (1) the allowance for doubtful accounts, (2) discount on bonds the accounting equation is usually expressed as payable, (3) sales returns and allowances, and (4) sales discounts. For example net sales is gross sales minus the sales returns, the sales allowances, and the sales discounts. The net realizable value of the accounts receivable is the accounts receivable minus the allowance for doubtful accounts. The totals for the first eight transactions indicate that the company had assets of $17,200. The accounting equation also indicates that the company’s creditors had a claim of $7,120 and the owner had a residual claim of $10,080.

]]>

Consider investing in technology that enhances operational efficiency, improves patient experience, and contributes to overall practice growth. Calculate the cost of https://www.bookstime.com/ acquiring new patients, factoring in marketing and advertising expenses. Ensure consistent and accurate recording of financial transactions throughout the accounting period. This forms the basis for generating precise financial statements.

How do I pick the best dental accounting service for my practice?

Many dentists report that switching to a specialized CPA results in tax savings and profit improvements that more than offset any premium in accounting fees. Dental practices can benefit from numerous tax deductions, many of which are industry-specific. Proper tax planning can significantly reduce your tax burden while maintaining full compliance with IRS regulations. Does your practice management software integrate with your accounting system? This integration can significantly reduce manual entry errors and improve revenue tracking accuracy. Diamond Accounting Hub specializes in providing expert accounting services tailored to meet the unique needs of businesses .

- Maintain detailed treatment plan documentation – Every treatment plan should clearly outline services, costs, and insurance coverage.

- As a dentist, you can figure out why a patient’s bottom front tooth hurts, when it’s time to pull wisdom teeth, and the best way to fill a cavity.

- Outsourcing bookkeeping services can be a strategic decision for dental practices looking to streamline financial management, enhance expertise, and focus on core business activities.

- Dental entrepreneurs battle claim delays, steep equipment costs, and seasonal dips.

- Dental practices have unique needs, from equipment depreciation to insurance billing, and a dental-focused bookkeeper can help you manage those details with ease.

Understanding Deductible Expenses for Dentists

1-800 Bookkeeping offers expert services to streamline your financial processes and empower you to make informed decisions. It helps you manage your money better, make more profit, and gives you more time to focus on Statement of Comprehensive Income taking care of your patients instead of worrying about the numbers. You should expect them to give you personal attention, offer smart money advice, and help you handle all the financial parts of running your dental office.

Best Practices for Maintaining Organized Bookkeeping Records for Dentists

Working with dental practice management experts can give a detailed look at your finances and operations. At Therapeutic Tax Solutions, we understand the unique tax and bookkeeping needs of the HVAC companies. Apply to work with us today and learn more about how we can help streamline your financial management and ensure compliance with tax regulations. Many outsourcing firms leverage advanced accounting software and technology.

- Over time, these categories help you see where your money is going and where you can cut back if needed.

- Let’s take a look at what makes accounting and bookkeeping different and how each one keeps your finances in order at your dental practice.

- They have always provided us with a comprehensive and top-rated service, allowing us to meet deadlines internally and externally.

- Review your profit and loss with your business partner, manager, or advisor.

- Deductions lower your taxable income, which indirectly cuts your tax bill.

How to Optimize Your Tax Planning as a Dentist?

Effective inventory control ensures that you have the necessary supplies without overstocking, which can tie up capital unnecessarily. Consider the value of time saved, the expertise gained, and the ability to focus on core business activities. The initial transition to outsourcing may require time for adjustment. Dentists and their teams need to adapt to new workflows and communication channels.

Nothing keeps an accounting firm more unified and productive than a clear set of repeatable tasks. A monthly bookkeeping checklist is more than a to-do list; it forms a critical part of your firm’s foundation. This timing gap highlights why cash flow management is particularly crucial in dentistry. The industry’s reliance on insurance reimbursements, which often come with unpredictable delays and adjustments, further complicates the cash flow picture. Many dental accounting software systems enable you to create a tailored chart of accounts that aligns with dental-specific categories.

Clearly, the subject of payroll taxes involves plenty of moving parts and covers a wide range of accounting knowledge. A U.S.-based international CPA can draw on expertise in all of these areas when advising you on your unique business setup. That means you should take the time to explore your financial statements and look for ways to improve your profitability, cash flows, or operational efficiency. Many businesses recognize this issue after their first few months or year of operations, but the damage is done by then. To avoid unnecessary accounting work, open separate business accounts before transitioning to practice ownership.

- This diligence is key to maintaining accurate financial statements and avoiding surprises down the line, contributing to the overall financial health of medical practices.

- If you already have an accountant, many solutions require you to retain your in-house accountant.

- So, we’ve talked about a lot of things, from keeping your books straight to making sure you’re not missing out on tax breaks.

- This specificity not only aids in accurate billing but also facilitates precise revenue recognition for each type of service provided.

You likely have many receipts, invoices, and other documents that you need to organize. And, if you are not familiar with accounting, trying to know how to do all the transactions and calculations can be confusing. Most businesses are required to pay taxes every three to four months. Calculate your estimated tax and pay on time to avoid penalties. Wondering what tasks you should (and shouldn’t) automate at your accounting firm? Get instant access to all the tools that make monthly bookkeeping tick with a free trial or demo of Karbon.

With their help, you can make audits easier, reduce risks, and focus on caring for your patients. Auditors often check travel, entertainment, and vehicle expenses. A dental CPA can guide dental bookkeeping you through these rules and help improve your records.

]]>The use of AI in surveillance technologies, such as facial recognition, can also raise concerns about constant monitoring and the violation of personal freedoms. AI systems can be susceptible to hacking or unauthorized access, putting sensitive information at risk. This can include sensitive information such as medical records, financial data, or even private conversations. In conclusion, the advancements in AI have the potential to greatly benefit the field of education. If algorithms are not developed and trained with diversity in mind, they may unintentionally reinforce existing biases and discrimination. Relying heavily on AI for educational purposes may hinder students’ ability to think independently and find creative solutions to complex problems.

Streamlined Business Processes

AI-powered systems can assist in diagnosing diseases, analyzing medical images, and developing personalized treatment plans. By harnessing the power of AI while taking necessary precautions, we can reap its benefits and avoid it becoming a bane for society. This can save lives by ensuring early detection and intervention, and can also help healthcare providers deliver personalized and targeted treatments to patients. However, like any technological innovation, AI comes with its own set of benefits and drawbacks, leaving many to debate whether it is a blessing or a curse.

Advantages and Disadvantages of AI: Key Pros and Cons

This threatens fairness in hiring, lending, policing, and more.An AI credit-scoring system that systematically disadvantages certain minorities because profit center: characteristics vs a cost center with examples of biased training data. AI can’t replicate human emotions, imagination, or empathy, qualities essential for leadership, the arts, and relationships. Lack of emotional intelligence is a drawback that must be considered, especially in industries that require creativity. In areas requiring emotional intelligence, human interaction may be irreplaceable.A robot doctor can propose treatment options, but cannot comfort a patient the way a human physician might. AI systems are expensive to build and maintain, requiring advanced hardware and constant updates.

“Decisions made by AI can tokyo olympic games get official 2021 dates raise real concerns around fairness and accountability, and there are real ethical concerns that we as human beings need to be aware of,” Ives says. By exemplifying human behavior, artificial intelligence puts itself—and its creators and users—at risk of breaching legal or ethical rules. AI can sift through data and generate outputs much faster than the human brain and body can process information, which makes completing routine tasks like writing an email or creating a meeting summary that much quicker. In the simplest terms, AI uses algorithms to analyze historic data, which then allows it to find patterns that can inform its decision-making.

Cost Reduction & Efficiency Gains

This dependence can reduce human skills and capabilities as individuals and organizations rely more on automated systems for decision-making and problem-solving. The rise of AI and automation technologies poses a substantial risk to employment, particularly in industries reliant on routine and repetitive tasks. As AI systems take over more responsibilities, individuals might become less inclined to develop their skills and knowledge, relying excessively on technology. While AI can be programmed to recognize specific emotional cues and respond in a predetermined way, it doesn’t possess genuine empathy or the capacity to navigate complex human emotions. Artificial Intelligence (AI) often lacks the intrinsic creativity of humans, which stems from emotional depth, abstract thinking, and imaginative processes. AI technologies excel at recognizing patterns in large datasets and can be used to solve complex problems across various domains.

- This increased accuracy can be a blessing in numerous industries, such as healthcare, finance, and transportation.

- “Communication is going to be key for organizations when it comes to implementing this type of technology into their workplaces,” Den Houter says.

- Additionally, AI can assist in predictive modeling, enabling businesses to make accurate forecasts and optimize operations.

- There is a risk that algorithms are being developed and deployed faster than regulatory frameworks and ethical guidelines can keep up.

- For example, AI-powered chatbots can handle customer inquiries and provide support, thereby improving customer service and reducing the need for human operators.

- It automates repetitive tasks but also creates new roles that need human creativity.

The automation of tasks previously performed by humans raises concerns about job displacement, particularly in industries that are heavily reliant on routine or repetitive tasks. Machine learning algorithms can analyze historical data and predict future outcomes, allowing businesses and individuals to make informed decisions quickly and accurately. One concern is the potential loss of jobs, as AI systems can replace human workers in certain industries. AI can also contribute to scientific research, facilitate data analysis, and automate tedious tasks, allowing humans to focus on more complex and creative endeavors. There is also a concern about job displacement, as AI can potentially replace human workers in certain tasks and industries. Overreliance on AI can lead to job displacement and unemployment, as machines take over tasks previously performed by humans.

Unlock Your Business Potential with Visive.ai

“Those repetitive tasks are really where you can create some really profound efficiencies,” Ives says. AI can offer multiple benefits to workers and individuals. In the world of artificial intelligence, a lot of jargon can get tossed around.

Lack of Creativity

One of the most pressing ethical challenges is the potential use of AI in warfare. Furthermore, the rapid advancement of AI technology poses challenges in terms of privacy and data security. When machines make decisions autonomously, it becomes difficult to assign responsibility for any negative consequences. Another ethical issue is the lack of accountability for the actions of AI systems. Additionally, AI algorithms can sometimes reinforce existing biases and prejudices, which can have detrimental effects on marginalized communities.

Improving Human Workflows

It is crucial to understand that AI is a tool, and like any tool, it is only as good as its user and the systems in place to control and monitor it. Hackers or those with malicious intent could exploit vulnerabilities in AI systems, causing chaos and harm. This is a drawback of relying heavily on AI – the lack of human judgement and intuition that can prevent such errors. However, if there is a flaw in the programming or if the AI system encounters unfamiliar or unexpected data, it can lead to incorrect or even dangerous outcomes. get your second stimulus check 2020 By steering AI development in a responsible direction, we can maximize its potential as a blessing rather than a curse. This includes ensuring transparency and accountability, safeguarding privacy and data security, and fostering fairness and inclusivity.

- If adequate measures are not taken to develop, test, and secure AI systems, the potential for malfunction remains.

- In 2020 a group of 17 criminals defrauded $35 million from a bank in the United Arab Emirates using AI “deep voice” technology to impersonate an employee authorized to make money transfers.

- It is important for businesses to find the right balance between automation and human interaction to ensure a positive customer service experience.

- Hence, it is safe to understand that learning and acquiring skills that go hand in hand with AI is certainly beneficial for future job markets and roles.

- Artificial Intelligence (AI) has rapidly transitioned from a theoretical concept to a tangible force reshaping industries and impacting daily life.

Benefitting means fewer errors, higher reliability, especially in critical tasks such as medicine or aviation. Let’s look at the key advantages of artificial intelligence & how it’s making our world faster and more efficient. From predictive analytics in finance to generative AI in marketing, industries worldwide are rethinking how they operate. AI enhances healthcare through precision medicine, early disease detection, and efficient patient management. AI is neither good nor bad, but a neutral tool whose configuration and usage determines the potential outcome. If you’re ready to build your foundation, start with this comprehensive artificial intelligence tutorial.

How Can Businesses Benefit From Adopting AI?

Some 48 percent of experts believed AI will replace a large number of blue- and even white-collar jobs (including Hollywood and TV script writing), creating greater income inequality, increased unemployment, and a breakdown of the social order. They can help thwart human trafficking, ensure girls and children all over the world receive the education they deserve, protect forests from illegal deforestation, support the health and safety of pregnant women and newborns, and so much more. Augments and amplifies human creativity and labor instead of simply replacing it….

For example, she says, multimodal AI could revolutionize genetic research by analyzing biomedical data, health records, and possibly even DNA. Multimodal in AI refers to models that can interpret multiple types of data. “It’s new and exciting, with what seems like limitless potential applications,” Den Houter says. Throw in the fast pace in which this technology is being developed and adopted, and a lot of negative emotions can arise. This has implications for consumers and businesses, like a rise in costs or supply chain blockages, as well as our environment if we continue to increase our carbon footprint and stale renewable energy efforts.

In the healthcare sector, AI can analyze medical records, images, and genetic data to assist in diagnosis and treatment decisions. Additionally, the incorrect or biased decisions made by AI algorithms can have detrimental effects, as they may lack the human intuition and context needed for certain tasks. One of the major advantages of AI is its ability to process and analyze vast amounts of data at a speed and accuracy unmatched by humans. As AI continues to advance, certain jobs that are currently performed by humans may be replaced by machines, leading to unemployment and economic disparities. AI can be used to automate tasks, analyze data, and solve complex problems.

Sometimes I hear tech people saying they are building machines that think like people. This is an impoverished view of who we humans are.… The brain is its own universe. It’s all just information processing, algorithms all the way down, so of course machines are going to eventually overtake us.

This has led to numerous scandals, from facial recognition software that struggles to identify people of color to hiring algorithms that favor male candidates. If that data reflects historical biases, the AI will likely reproduce—and even amplify—those biases. The risk is not just about losing jobs—it’s about losing the ability to decide for ourselves. When opaque algorithms determine who is granted bail or subjected to monitoring, the foundations of justice can be eroded.

Income inequality was exacerbated over the last four decades as 50–70 percent of changes in American paychecks were caused by wage decreases for workers whose industries experienced rapid automation, including AI technologies. An October 2020 World Economic Forum report found 43 percent of businesses surveyed planned to reduce workforces in favor of automation. About 11,000 retail jobs were lost in 2019, largely due to self-checkout and other technologies.

AI can process huge amounts of structured and unstructured data (text, images, video) and extract insights that we humans might miss. This benefits as it frees up human workers to focus on more strategic, creative, or complex work. AI takes over routine, laborious tasks that would otherwise occupy human time and energy.

]]>